ESG, CSR & Sustainability

Corporate Social Responsibility (CSR) Report

“Colchester is founded on a belief that asset management is best performed in a singular focus firm, such as ours, that puts the interests of our clients at the centre of everything we do. We believe that this delivers meaningful outcomes to our clients, avoids potential conflicts of interest, and aligns our interests with those of our clients. As guardians of other people’s money, Colchester is underpinned by strong moral and ethical standards, a deeply engrained investment process, and a structure that provides the best possible chance of success. We believe that clarity of thought and vision, combined with a relentless drive for excellence, will deliver the best outcomes for our clients and help them achieve their objectives. We view our clients as partners and believe that openness and transparency is paramount in building and developing the trust that they have bestowed upon us. These values and principles are embedded in our DNA, and guide us in all our interactions with, and decisions made on behalf of, our clients.”

Keith Lloyd, Group CEO and Deputy CIO

Colchester Global Investors

Environmental, Social, and Governance

The factors that underpin the Colchester investment process are wide ranging incorporating macro-economic and financial analysis alongside Environmental, Social and Governance factors (ESG). Responsible investing is and has been since the inception of the company in 1999, integral to the investment process employed by Colchester.

Colchester believes that countries with better ESG standards tend to produce better economic growth, more stable balance sheets, and better long-term and sustainable outcomes.

In December 2016, Colchester became a signatory to the UN Principles of Responsible Investment (‘UNPRI’). Since becoming a PRI signatory, Colchester’s adherence to the Principles for Responsible Investment has led to our involvement in numerous industry collaborations in the form of white papers, discussion panels and most recently a podcast.

Colchester has signed the PRI ESG Credit Risk and Ratings Initiative and has also fed back to the Technical Expert Group on sustainable finance (TEG) on Green Bond Standards.

Colchester has become a member of the steering committee of the Emerging Market Investors Alliance (EMIA) on Carbon Transition Initiative. The initial goal is to educate investors on the risks and opportunities related to decarbonisation in emerging markets.

Colchester Information

Collaborative Papers to Read

Colchester and Responsible Investing

Claudia Gollmeier, Colchester Senior Investment, discusses how Colchester incorporates responsible investing principles into its investment process.

A practical guide to ESG Integration in Sovereign Debt

Claudia Gollmeier, Colchester Senior Investment Officer and as Chair of the PRI Sovereign Debt Working Group, has contributed to further work in this important field.

ESG Factors and Integration in Colchester’s Investment Process

We are pleased to share our ESG integration process in this short video, presented by Colchester’s Senior Investment Officer Vi-Minh Tran. Vi explores the importance of complementing traditional sovereign balance sheet analysis with a systematic integration of Environmental, Social and Governance (ESG) factors to allow us to fully assess the financial stability of those developed and developing markets in which we may invest.

Modern Slavery

Modern slavery is a term that is used to cover practices such as forced labour, debt bondage, forced marriage and human trafficking. Essentially, it refers to situations of exploitation that a person cannot refuse or leave because of threats, violence, coercion, deception and/or abuse of power. Colchester is strongly opposed to modern slavery and does not engage in, or knowingly conduct business with any organisation involved in, such activities.

As a signatory to the UNPRI, we have implemented and adopted the six principles of responsible investment into our investment process. Therefore, in addition to seeking to ensure that our own business and supply chains are free from modern slavery, our investment process in accordance with the UNPRI in turn reflects our commitment to assess and review modern slavery holistically.

Colchester expects the highest standards of ethics and integrity and opposes all forms of discrimination, harassment or victimisation. The Colchester Code of Ethics, to which all employees are subject, requires an attitude of integrity and trust. Colchester’s clients’ interests take precedence over any other interests at Colchester. Colchester employees are subject to a number of other policies which create an environment where modern slavery would not be tolerated.

Evaluating the possibility or prevalence of modern slavery is an important component of our assessment of a country’s financial stability score, which in turn, is integral to Colchester’s investment process.

The prevalence of modern slavery in a country is among the social factors we evaluate as part of the ESG assessment. We recognise that many risk factors can contribute to modern slavery such as poor governance, weak political and social stability, inequality and corruption. We look to gain an understanding of the overall conditions in a country and evaluate the risk from all these perspectives. Often a high level of modern slavery in a country is a symptom of other serious governance failures. Incorporating ESG-related assessments within our financial stability score is about ensuring that we encompass all the relevant risk factors when deciding on which countries to invest in.

Sovereign Engagement

Responsible Investing is, and has been since the inception of Colchester, a fundamental part of our investment process. Environmental, Social and Governance (ESG) factors are incorporated along with macro-economic and financial analysis within our investment valuation framework. Our Sovereign Engagement Framework explains how we integrate engagement holistically into our investment process. We believe that enhanced and clear policies can improve a country’s business environment, which in turn reduces country investment risk, funding costs, supports economic growth and should ensure more sustainable debt paths. This ongoing sovereign engagement, if done effectively, should be recognised as being mutually beneficial for issuers and investors.

Colchester has engaged with multiple country stakeholders since the inception of the firm. Our engagement with governments and government-related institutions fosters a two-way process whereby issuers can also address balance sheet issues and ESG factors. We believe that our objective unbiased opinions and sharing of global experiences with government and other entities throughout the years, has been positively received by those sovereigns we have engaged with. Such activities support and promote Colchester’s commitment to Principle 2 ‘We will be active owners and incorporate ESG issues into our ownership policies and practices’ of the six Principles for Responsible Investment.

We monitor our engagement activities individually or on a collaborative basis for progress and track the responses against our objectives. Details of engagements, as well as with other relevant parties such as index providers and industry bodies are recorded.

Podcast - ESG In Sovereign Debt Analysis

Claudia Gollmeier discusses ESG factors and the role of engagement within Sovereign Bond Analysis with Kristian Hartelius, Head of Quantitative Strategies at AP2, and Carmen Nuzzo, Head of Fixed Income at the PRI.

Colchester’s ESG Sovereign Engagement Insights

Jean Lee, Investment Officer presents Colchester’s thoughts on the importance of ESG issues with sovereigns, climate risk and how engagement opportunities assist to evaluate ESG and other risks which in turn allows for a better assessment of sovereign valuations.

Climate Change

The Financial Stability Board is an international body that monitors and makes recommendations about the global financial system, and they created the Task Force on Climate-related Financial Disclosures (TCFD) to improve and increase reporting of climate-related financial information.

The TCFD has developed a framework to help organisations more effectively disclose climate-related risks and opportunities through their existing reporting processes. Colchester became a supporter to the TCFD in May 2019 and has adopted their goal to improve transparency and reporting on climate related risks and opportunities.

To that end, Colchester has established its own TCFD Advisory Committee internally, which reports directly to the Colchester Board. This Committee’s membership comprises representatives from across the Group to ensure diversity of opinion; Investment Management, Marketing & Client Service, Operations, Legal and Compliance, and Risk.

The Committee’s primary purpose is to assess appropriate group-wide metrics and targets which contribute to a positive impact on climate change in the short and long term and increase the transparency of those activities, decisions and outcomes. All proposals and suggestions are reviewed by the Committee, and those that are to be adopted, are subject to Board approval.

Colchester’s TCFD Advisory Committee has published its first annual Sustainability Report for our clients and interested parties’ information.

In addition to these climate related initiatives, in October 2020, Colchester became a member of the steering committee of the Emerging Market Investors Alliance (EMIA) on its Carbon Transition Initiative. The initial goal is to educate investors on the risks and opportunities related to decarbonisation in emerging markets. The initiative looks at the impact of climate and the low carbon transition on emerging market countries and industry sectors.

Green Bond Report by Scope Analysis

The rising popularity and issuance activity of green bonds is leading to significant growth in green bond funds – both in terms of the number of funds and the assets. Colchester’s new Green Bond Fund is highlighted.

Green Bond Funds – Assets under management more than double in one year:

Operational Sustainability

Colchester is committed to investing responsibly and operating sustainably. We have consistently applied our core values of Focus, Integrity and Trust, Perspective, Service, Humility, Teamwork and Devolved Leadership, and Innovation and Constant Improvement to our investment management, business practices, interactions with clients and other stakeholders and the way we treat the environment. As a growing organisation, Colchester aims, to the best of its ability, to manage the business economically without the waste of the planet’s valuable resources.

Colchester implements policies and employee guidance on initiatives targeting Waste Reduction and Recycling, Emissions Reductions, Energy Efficiency and Water Conservation. These are reviewed annually and are applied across Colchester’s global offices.

Some examples of our initiatives are:

Focus on Environmental Impact

Improving our recycling efforts, energy efficiency and reducing consumption of water and energy resources. Moving to paperless departments and offices, and focusing on a reduction in travel related carbon emissions.

Technological Infrastructure Enhancements

Implementing an improved infrastructure using Cloud technology, with a robust Cyber Security Framework and a fit for purpose Business Continuity and Disaster Recovery Plan.

External Service Provider Due Diligence

Rigorous operational due diligence of our third-party service providers, with further work to enhance pre-engagement and oversight.

Client Charter

Colchester’s core values have always been at the heart of how we service our clients. It is our mission and promise to partner with clients to provide service that is not only helpful, timely and meaningful, but also enriches the investor experience. We do this through paying special attention to our customers’ needs and requests and placing them as highest priority. This approach is embedded in our culture and is evidenced by the personalised customer service that clients receive; to this end, our Colchester Client Charter underpins all our interactions.

At Colchester, we don’t assume that we always provide service up to or beyond our clients’ expectations, and continually strive to improve. We welcome feedback from all our clients and proactively seek feedback on their views on a wide range of topics. Our ‘Client Service Engagement Survey’ formally seeks feedback on the quality of our Client Service and Marketing Engagement, areas of interest with regards Product, Research and Educational Material, and whether our Performance Reporting is sufficient and timely. Clients are invited to provide this feedback online and can remain anonymous if preferred. It’s our intention to regularly survey our clients as part of our efforts to continually improve. Feedback is shared and discussed amongst the team and new ideas and areas of focus are implemented.

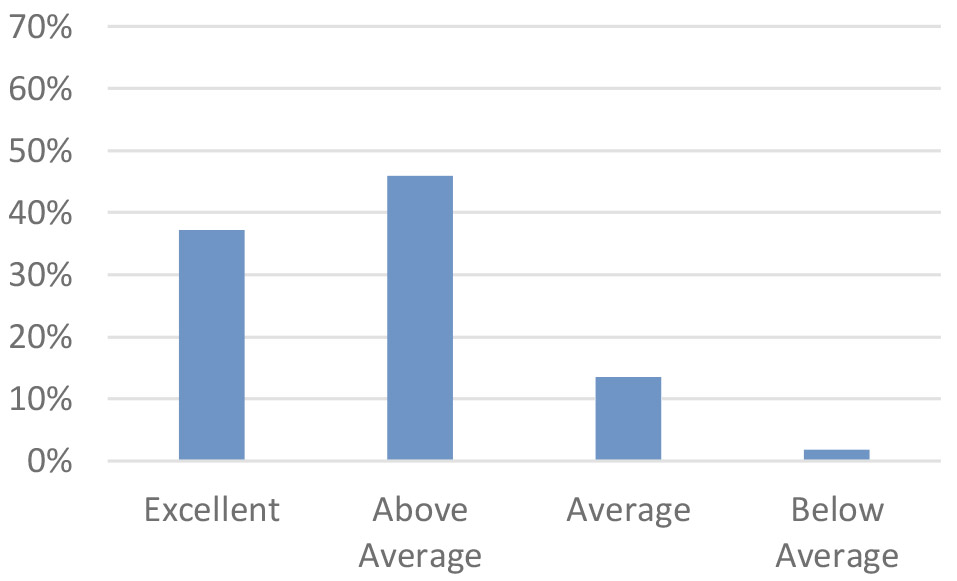

Recent Client Survey Results

(from 67 respondents in March 2022)

How would you rate your overall client experience with Colchester?

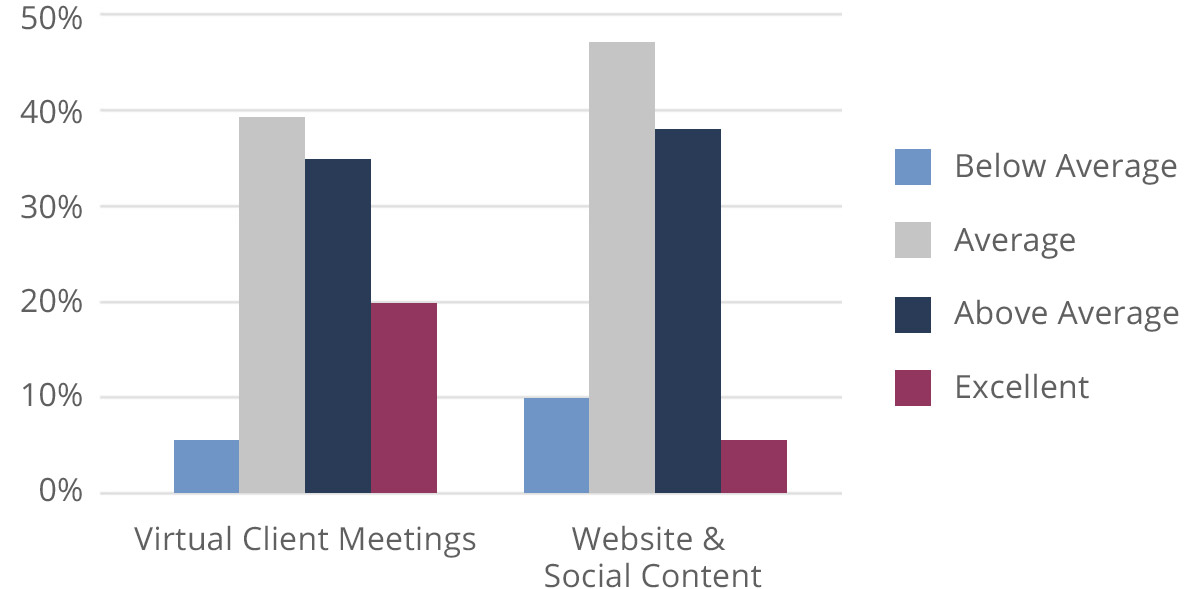

Given the pandemic and a shift to increased virtual use, how would you rate us on the following:

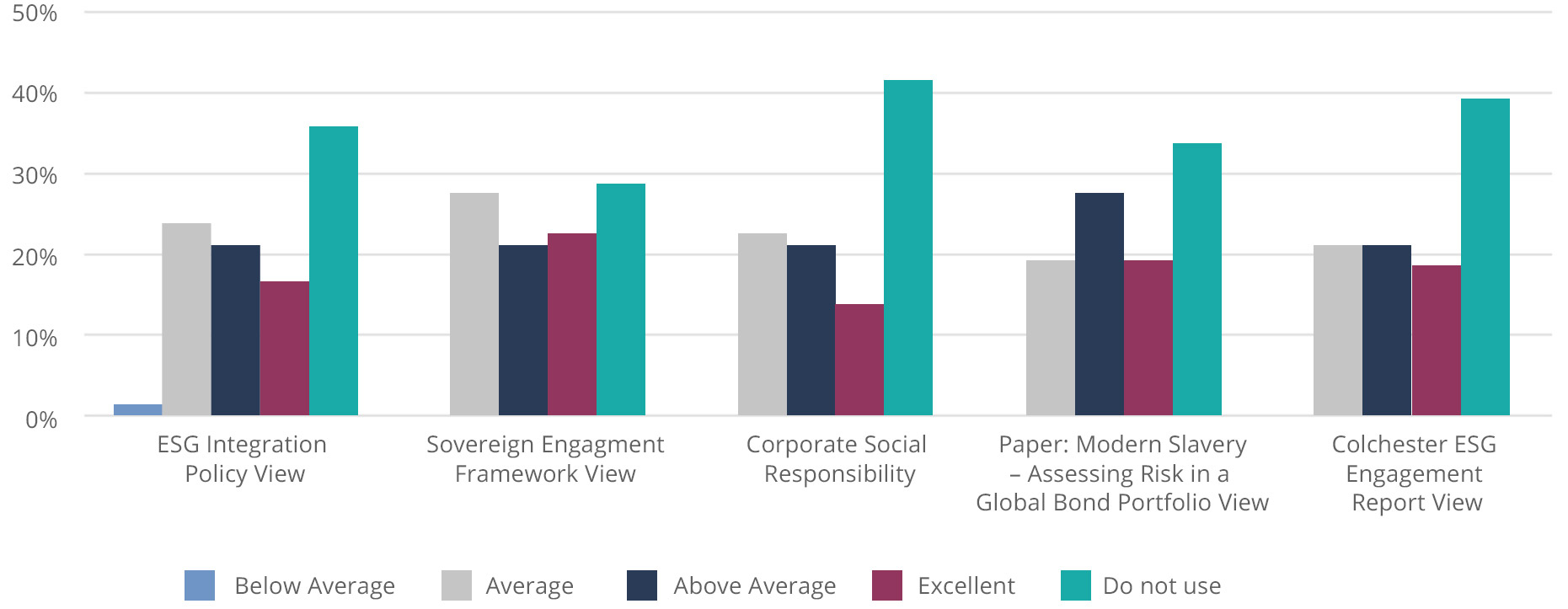

With regards to your thoughts on ESG, please rate us on the following:

Please let us know specifically where we can improve our service to you?

*Other – drew comments relating to wanting more webinars to deliver our insights & research pieces, inflation forecasts, and macro view updates.

Diversity & Inclusion

Colchester is built on our core values which form the foundations of our culture and underpin everything we do. Our policies are designed to promote our values and protect our employees. We pride ourselves on having a culture where differences are not only respected but welcomed. We believe that every one of our employees, clients and stakeholders bring something different to the table and those differences are something to be valued. Only by recognising those differences can we attract the best people, develop and use their talents, and create a great place to work.

We actively promote integrity, trust and humility, all of which form part of our core values. We understand that being good at what we do takes collaboration, teamwork and respect for each other and we work hard to embed this into our inclusion efforts. Fostering this inclusive culture is crucial to our employees and clients who are at the heart of everything we do.

We are committed to growing and nurturing diversity within Colchester creating an inclusive environment, where our workforce is truly representative of all sections of society and our employees feel respected and confident to bring their whole selves to work each day.

Colchester’s Women in Finance present: Our Path to Success – Inclusion is the Key to Growth

Humility and respect for others is one of Colchester’s core values and we are committed to growing and nurturing diversity within the firm but also more broadly where we can. We celebrate diversity and inclusion with our latest Colchester’s Women in Finance video ‘#Inclusion is the key to growth’, where our employees share their thoughts and advice to help inspire the next generation.

Employee Facts & Figures

40%

of our Employees globally identify as female (6% prefer not to say/opt out)

40%

of our Board identify as female

40%

of our Senior Management Team* identify as female

33%

of our Investment Officers identify as female

5%

of our Employees are veterans (7% prefer not to say/opt out)

18%

of our Employees have a MSc, MA or PhD (9% prefer not to say/opt out)

41yrs

Average employee age

Languages Spoken (2 or more)

43%

of our Employees (7% prefer not to say/opt out)

40%

of our Senior Management Team

58%

of our Investment Officers

22

different languages are spoken across Colchester

These include English, Arabic, Cantonese, Kurdish, French, Portuguese, Korean, Croatian, Italian, German, Mandarin, Gujarati, Hindi, Fujianese, Shona, Spanish, Finnish, Urdu, Telugu, Twi, Malay and Japanese.

Ethnicity (Minority Representation)

34%

of our Employees are from an ethnic minority group (7% prefer not to say/opt out)

17%

of our Investment Officers are from an ethnic minority group

21%

of our Investment, Risk & Dealing Teams are from an ethnic minority group (4% prefer not to say/opt out)

Education

66%

of our Employees have a BSc or BA or higher (9% prefer not to say/opt out)

66%

of our Employees attended state run non-fee paying schools (11% prefer not to say/opt out)

Ethnicity across Colchester MCS** Team

Diversity within our Marketing and Client Service team enables us to better service our global client base with an experienced team based across our global offices in London, Dublin, New York, Singapore, Sydney and Dubai. We have a diverse range of backgrounds and nationalities:

31%

are from an ethnic minority group

44%

speak 2 or more languages

6

different languages are spoken

Evenly split by gender with 50% identifying as female

*Senior Management Team (SMT): Directors and Global Heads of Department who attend SMT Meetings.

**MSC stands for Marketing and Client Service.

Data accurate as of 1 April 2022.

Contact us for more details.

Read about our global bonds offering.

Meet the Colchester Team.

Watch our recent video insights.

Subscribe now

*required field